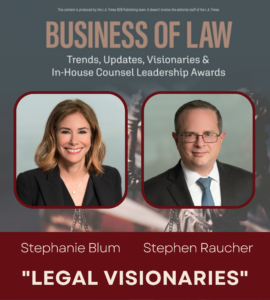

Stephen Raucher and Certified Specialist Stephanie Blum have been recognized as “Legal Visionaries” in the second annual Business of Law magazine published by L.A. Times B2B Publishing. The special supplement spotlights attorneys that have “exhibited noteworthy achievements” over the last two years. Read the press release here.